U.S. Securities and Exchange Commission (SEC) has rejected an application by Chicago Board Options Exchange (CBOE) to list bitcoin Exchange-traded funds (ETF’s) on behalf of the Winklevoss brothers.

The regulator argued that CBOE doesn’t have the means to safeguard the marketplace from potential manipulations and perhaps more importantly, suffers from a lack of liquidity since it was to be traded through the brothers’ Gemini cryptocurrency exchange, which SEC argued has relatively small trading volumes.

“BZX has not demonstrated that bitcoin and bitcoin markets are inherently resistant to manipulation…”

Notably, one of SEC’s commissioners, Hester Peirce who has been outvoted 3 to 1 on the matter, has slammed the agency for rejecting the application of CBOE to list Winklevoss Bitcoin Trust on Bats BZX Exchange both in a statement listed on SEC’s web page and on twitter:

Apparently, bitcoin is not ripe enough, respectable enough, or regulated enough to be worthy of our markets. I dissent: https://t.co/gH5zXaKtmj

— Hester Peirce (@HesterPeirce) July 26, 2018

This marks a second time an application by CBOE was rejected by the agency in just over a year. Winklevoss had earlier requested to revisit their earlier rejection after adding positive comments from the public to the case. However SEC this time argued that crypto exchanges do not possess the means to police trading nor the regulatory oversight needed:

“BZX, as the ETP listing exchange, must enter into surveillance-sharing agreements with, or hold Intermarket Surveillance Group membership,”

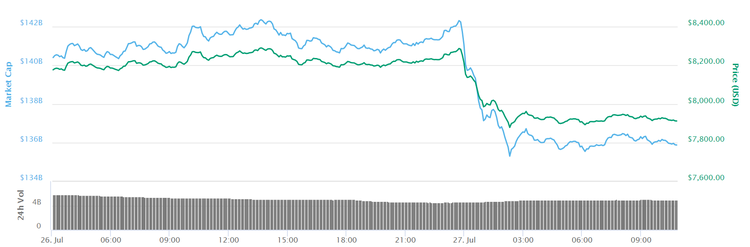

As of the past week, bitcoin has been making steady gains in part due to the speculation that a first bitcoin ETF may be accepted. Furthermore, another organization, Bitwise has filed an application to trade an ETF index of top 10 cryptocurrencies. Regulator’s decision marks a major setback for the industry and the cryptocurrency community.

In addition, prior to its decision, SEC has revealed the results of it’s request for public comment, regarding the ETF proposal. Of the 210 comments that came in, 97% were in favor of the proposal which send the market into further growth.

After the news broke, bitcoin fell by 4% to around $7,850. It has since then returned towards the $7,900 figure. But that fall is small in comparison to the one the top cryptocurrency suffered after the first rejection by SEC and to its fall from almost $20,000 which was reached towards the end of 2017.

Recently, the U.S. Securities and Exchange Commission (SEC) said that it needed two more months (till September 21) to decide whether to approve five bitcoin-related exchange-traded funds (ETF) offered by the investment company Direxion Asset Management.